montgomery county al sales tax

You can find more tax rates and allowances for Montgomery County. Tags and Registration.

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Tax Chicago

See if the property is available for sale or lease.

. Alabama has recent rate changes Thu Jul 01 2021. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Montgomery AL 36104-1667 334 832-1250.

Taxpayer Bill of Rights. The average cumulative sales tax rate between all of them is 932. A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax.

Alabama AL Sales Tax Rates by City all The state sales tax rate in Alabama is 4000. If you need information for tax rates or returns prior to 712003 please contact our office. Montgomery AL 36104 Phone.

The Montgomery County sales tax rate is. To report non-filers please email. Montgomery County in Alabama has a tax rate of 65 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Montgomery County totaling 25.

Has impacted many state nexus laws and sales tax collection requirements. Some cities and local governments in Montgomery County collect additional. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions.

6 rows The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state. 4 rows Montgomery. The most populous location in Montgomery County Alabama is Montgomery.

The December 2020 total local sales tax rate was also 9500. The 2018 United States Supreme Court decision in South Dakota v. These tax sale procedures are unique to Montgomery County and may differ from those used in other.

The Alabama sales tax rate is currently. Real Property Tax Calculations. Free viewers are required for some of the attached documents.

Instructions for Uploading a File. Please click on the link below to show examples of property tax calculations by different municipal codes within Montgomery County. Search Jobs Agendas Minutes Employee Login.

SalesSellers UseConsumers Use Tax Form. To review the rules in Alabama visit our state-by-state guide. City of Montgomery License and Revenue Division CO Department RBT3 PO Box.

For Levy Year 2021 the sale will take place on Monday June 13 2022 between 800 am. The Montgomery sales tax rate is. The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor beverages sold for consumption.

3 rows Montgomery County AL Sales Tax Rate The current total local sales tax rate in Montgomery. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax deed to the property by surrendering the Montgomery County Alabama tax lien certificate to the Judge of Probate who in turn issues a tax deed Sec. Eastern Time ET in the Division of Treasury Department of Finance located at 27 Courthouse Square Suite 200 Rockville Maryland 20850.

Automating sales tax compliance can help your business keep compliant. Sales Tax Audit. However However pursuant to Section 40-23-7 Code of Alabama 1975 you may request quarterly filing status if you have a tax liability of less than 240000 for the preceding calendar year.

Did South Dakota v. As far as other cities towns and locations go the place with the highest sales tax rate is Montgomery and. Find properties near County Rd.

This is the total of state county and city sales tax rates. Montgomery County AL Home Menu. View photos public assessor data maps and county tax information.

334-625-2994 Hours 730 am. The minimum combined 2022 sales tax rate for Montgomery Alabama is. The rate type is noted as Restaurant in MAT.

The current total local sales tax rate in Montgomery County AR is 9500. What is the sales tax rate in Montgomery Alabama. The Montgomery County Sales Tax is 25.

If the property is not redeemed within the 3 three year redemption period Sec. To report a criminal tax violation please call 251 344-4737. The Alabama state sales tax rate is currently.

View information about County Rd Montgomery AL 36130. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail. With local taxes the total sales tax rate is between 5000 and 11500.

Select the Alabama county from the list below to see its current sales tax rate. Motor FuelGasolineOther Fuel Tax Form. The County sales tax rate is.

The current total local sales tax rate in Montgomery AL. 2022 please begin remitting sales business tax and business license returns and payments to the remittance address below. AL Sales Tax Rate.

Alabama Sales Tax Guide And Calculator 2022 Taxjar

Revenue Department Clarifies Tax Exempt Sales Notice Alabama Retail Association

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Why Your Home Inspection Matters Infographic In 2022 Home Inspection Home Buying Process Real Estate Articles

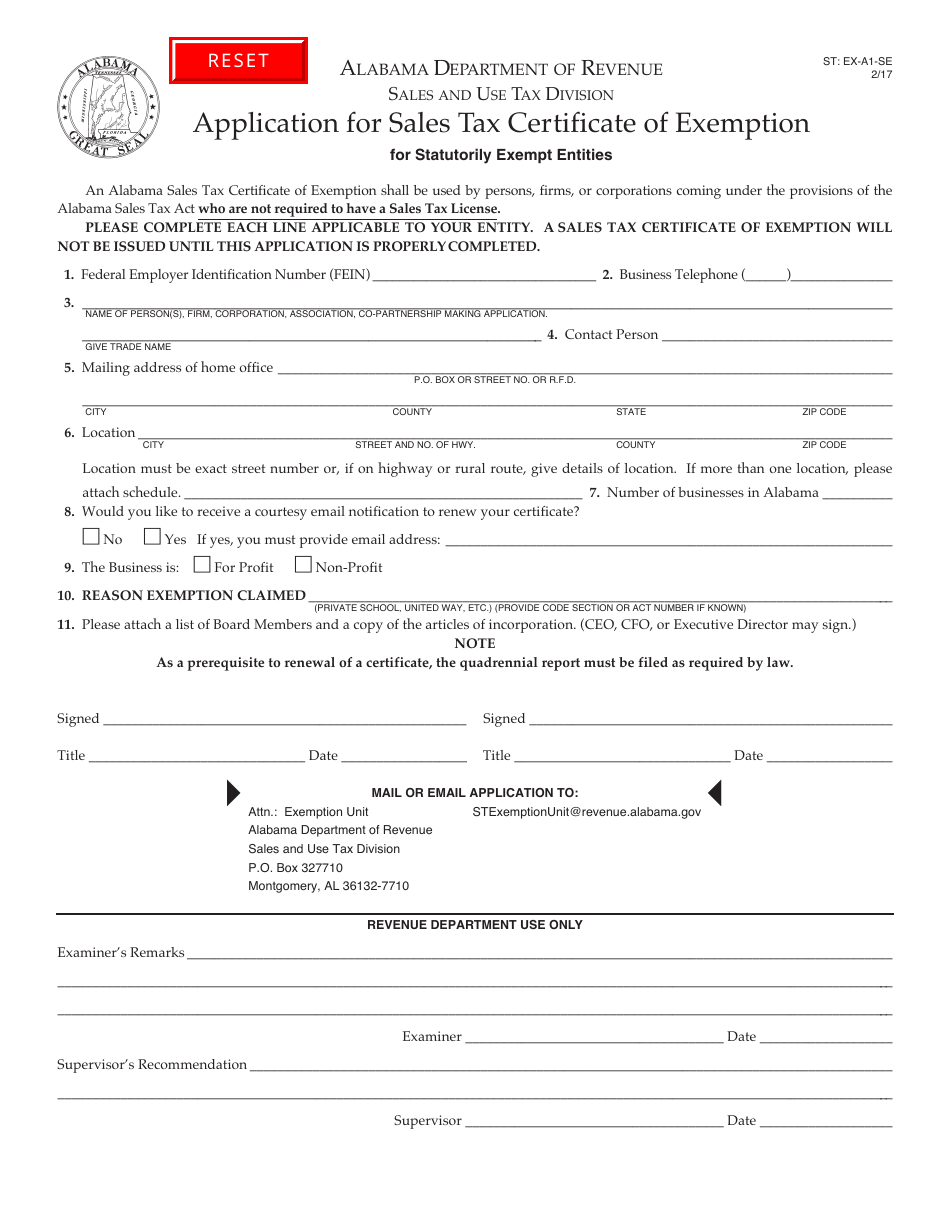

Application For Sales Tax Certificate Of Exemption Alabama

Sales Tax Alabama Department Of Revenue

Sales Tax Audit Montgomery County Al

Alabama Sales Tax Rates By City County 2022

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Alabama Sales Tax Guide For Businesses

Sales And Use Alabama Department Of Revenue

Alabama Sales Tax Guide For Businesses

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price