pa educational improvement tax credit election form

Question 1 Question 2 185 of Federal Poverty Level. PA tax savings 13333 gift x 90 credit 12000.

Pa 1123 form ease of use affordability and security in one online tool all without forcing extra ddd on you.

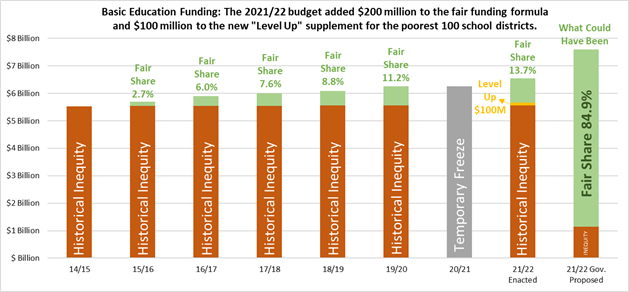

. Use the REV-1123 Educational ImprovementOpportunity. Act 32 Mediation Guidelines. For the 2021-22 school year the maximum scholarship award available to non-special education students is 8500 and the maximum for a special education student is 15000.

MY PA STATE TAX IS 12000 AND I AM AT 32 FEDERAL TAX RATE. All you need is smooth internet connection and a device to work on. A complete form OC is also required.

Political Committee Registration Statement DSEB-500 Use this form to register a new political committee. Tax questions may be directed to the Department of Revenue at 717-772-3896 or ra-rvtaxcreditspagov. Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400 North Street Harrisburg PA 17120.

Eligibility for the scholarships is limited to students from low- and middle-income families. Taxpayers must complete the REV-1123CT Irrevocable Election to Pass Through Educational Improvement Tax Credit to Shareholders members or partners owners form. Scholarship Tax Credit Election Form to report the amount.

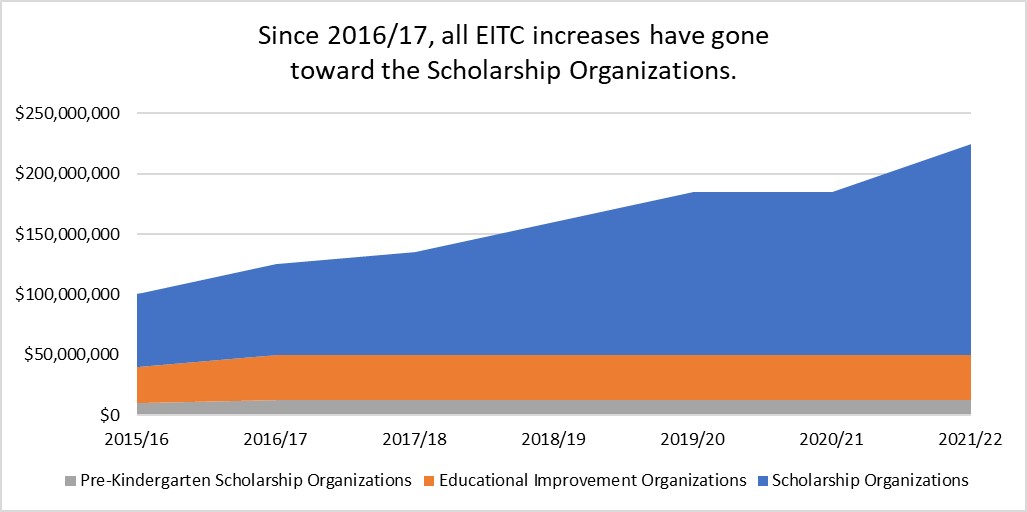

Pennsylvania makes millions of dollars available each year through the Educational Improvement Tax Credit Program EITC to be used as tax credits. Businesses individuals and schools. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds.

How to make an eSignature for your Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 495193552 online. Educational Improvement Tax Credit Program EITC Archived. Educational Improvement Tax Credit Program EITC Guidelines.

A Pa SPE K-1 will be provided by mail in February so the donor has proof of their eitc tax credit. Do not use the Single Application. Employer Annual W2-R Form.

How do I properly complete the OSTC Appendix XV Annual Report. Employer Login ESS Opens In A New Window. To pass through an Educational Improvement or Opportunity Scholarship Tax Credit complete and submit form REV-1123 Educational ImprovementOpportunity Scholarship Tax Credit Election Form.

PSERS Forms Publications and Presentations Forms. Return the election form to. Member Login MSS Fraud Waste and Abuse Reporting.

PA DEPArTMENT OF rEVENuE BurEAu OF COrPOrATION TAxES - EITCOSTC uNIT PO BOx 280701. Donation to CSFP through CSFP LLC. Net cost to provide 7 low-income children with a quality foundational education.

The EITC program enables businesses and individuals to support private schools such as Penn-Mont Academy a recognized 501 c. Act 32 Mediation Guidelines. Irrevocable election to pass educational Improvement tax Credit eItCopportunity Scholarship tax Credit oStC through to shareholders members or partners.

A program that benefits. Applicants can contact the Tax Credit Division at 7177877120 to be connected to their assigned project analyst. Federal tax savings 1333 net charitable deduction x 32 tax rate 427.

Employer Annual W2-R Form. Of Educational Improvement Tax Credit EITC or Opportunity Scholarship Tax Credit OSTC awarded to a pass-through entity or special purpose entity along with the amounts of the EITC or OSTC to be passed through to the. A pass-through EITCOSTC can be applied to all classesof income earned by the owners.

Pennsylvania Department of Community and Economic. Irrevocable election to pass Educational Improvement Tax Credit EITC through to shareholders members or partnersA separate election must be submitted for each year an EITC is awarded and not used in whole. Irrevocable election to pass Educational Improvement Tax Credit EITC through to shareholders members or partnersA separate election must be submitted for each year an EITC is awarded and not used in whole or in part by the contributing entity.

Elections must be received by the tax report due date for. About 68 percent of Pennsylvania students. To pass through a Keystone Innovation Zone tax credit visit the Department of Community and Economic Developments DCED website at dcedpagov or call DCED.

Local level committees are to file with the county board of elections. The program budget was capped at 135 million that year The program is most popular in Montgomery County where businesses and individuals claimed 35 million in tax credits on 39 million in charitable gifts. Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

In return they received a total of 124 million in Pennsylvania tax credits. Download File Educational Improvement Tax Credit Program EITC Guidelines. Department of State Bureau of Campaign Finance Lobbying Disclosure 500 North Office Building Harrisburg PA 17120.

Individual donors must file a Pa 40 individual or joint tax return for the year and include the 90 payment tax credit on page 2 line 23 other credits. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to expand educational opportunity. HARRISBURG PA 17128-0701 EDUCATIONAL IMPROVEMENT TAX CREDIT ELECTION FORM See Page 3 for instructions.

To make an irrevocable election to pass-through an EITC to partners members or shareholders a business must complete form. HARRISBuRg PA 17128-0701 eDUCAtIoNAL IMPRoVeMeNt oPPoRtUNItY SCHoLARSHIP tAX CReDIt e LeCtIoN FoRM See Page 3 for instructions. Election to apply unused EITCOSTC to the tax liability of the owners in the taxable year immediately follow-ing the year in which the contribution is made.

HARRISBuRg PA 17128-0701 eDUCAtIoNAL IMPRoVeMeNt oPPoRtUNItY SCHoLARSHIP tAX CReDIt e LeCtIoN FoRM See Page 3 for instructions. You may also use it to amend the original. REV-1123 -- Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1190 -- Tax Worksheet for PA-20SPA-65 Schedule M Part B Section E Line a REV-1849 -- Business Operations Questionnaire.

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Not Light But Fire How To Le Ad Meaningful Race Conversatio Kay Matthew R Kay Matthew R Books Amazon

Fill Free Fillable Forms For The State Of Pennsylvania

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Pa Tax Update 2021 R D Credit Award Letters Delayed Until May 1 2022

Do You Need To File A Tax Return In 2022 Forbes Advisor

Not Light But Fire How To Le Ad Meaningful Race Conversatio Kay Matthew R Kay Matthew R Books Amazon

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Information For Donors Faith Builders Educational Programs

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Def 14a 1 Nc10021080x1 Def14a Htm Def14a Table

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Tompkins Vist Bank Contributes To Youth Education Organizations Daily Local

Gop Advances Bill In Pennsylvania Senate That Would Further Expand Private School Tax Credits 90 5 Wesa

Framing Non State Engagement In Education

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation